The state of our kombucha market is strong.

That was the primary takeaway from Bobbi Leahy, Director of Sales at market research group SPINS, during her presentation at the Kombucha Brewers International KombuchaKon 2019 on April 19 in Long Beach, Calif. Analyzing the state of the market and forecasting future trends, Leahy highlighted kombucha’s ongoing evolution and emergence out of the natural channel. Still, like anything else, the devil is in the details. Having reviewed the data and spoken to Leahy about her conclusions, here are our three biggest takeaways from SPINS’s kombucha market performance analysis.

Growth And Velocity Slowing

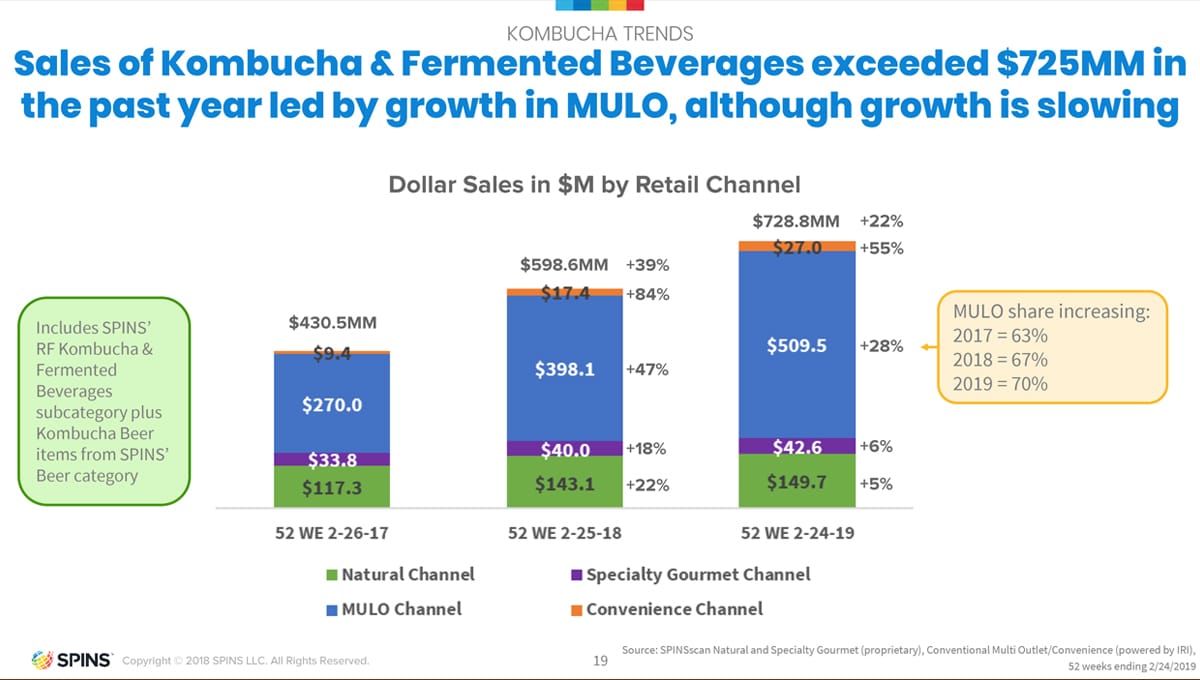

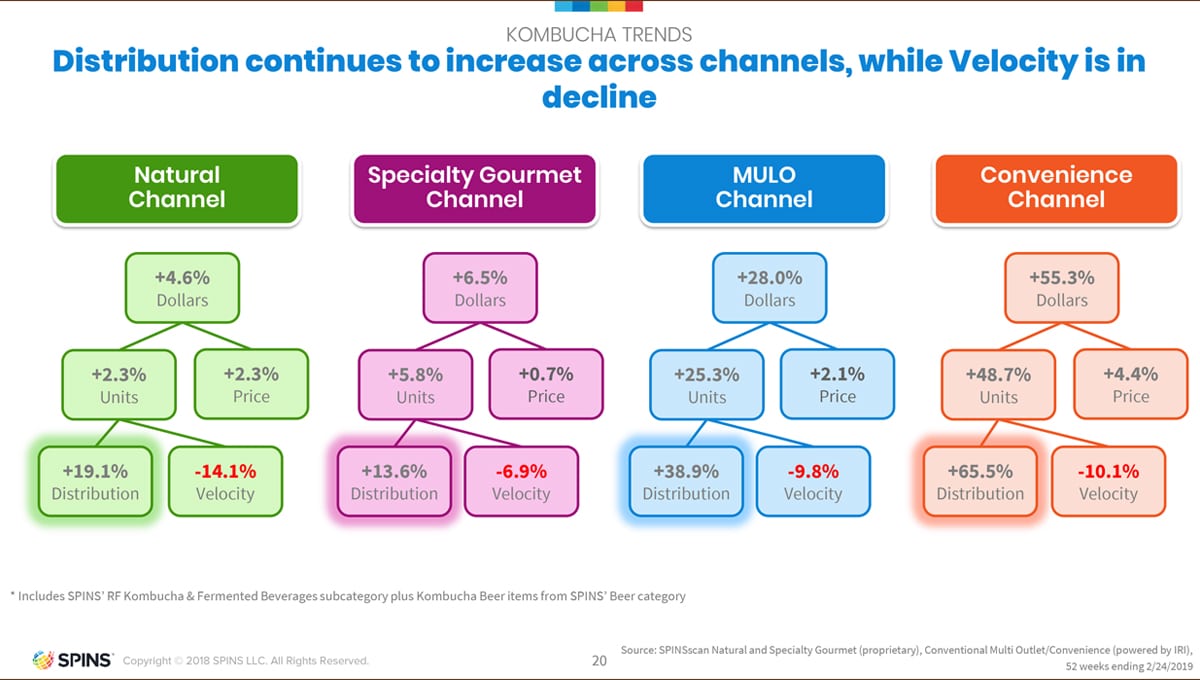

Simply put, across all retail channels, kombucha isn’t growing as fast as in prior years. That is partly a result of natural maturation of the segment; having been seeded in natural retailers, much of kombucha’s recent growth has come as it has moved into more conventional outlets, which account for 70% of the total category share as of 2019. Distribution gains were significant in MULO — food, drug, mass, and club –(38.9%) and convenience (65.5%), and were also up in natural (19.1%) and specialty gourmet (13.6%) retail. Dollar sales for kombucha as a whole grew 22% in the past year to reach $728.8 million.

Yet growth was off, in some cases by double-digits, within each retail segment. Having grown 22% in 2018, natural channel dollar sales grew only 5% in 2019. Growth in the specialty gourmet retailers also decelerated, dropping from 18% in 2018 to just 6% last year. Convenience stores are the fastest growing segment of the market — up 55 % in 2019 — but the smallest ($27 million).

Velocities were also down across the board, with natural (-14.1%) and convenience (-10.1%) taking the biggest hits. In MULO and specialty gourmet channels, velocity was down 9.8% and 6.9% respectively.

By themselves, these declines aren’t cause for concern; Leahy noted that the industry is “healthy” and the dips in sales and velocity are a result of the segment’s maturation. She said, however, that the combination of falling velocities and increases in distribution indicate that a “reckoning” is inevitable.

“At some point retailers are going to evaluate the market and say ‘I love that we got a bigger kombucha set, but we may be too big and need to resize,’” she said. “Those growths in distribution are dramatic but unless people find it in the store and buy it, there will be a right-sizing of the category coming down the pike. A couple of months down the road, buyers may seek to pull back and focus on what items are really producing for them, so maybe some of the more unique flavors or larger sizes.”

Larger Packaging is Having An Impact

Single-serve kombucha is still dominating dollar share, but the influence of larger bottles and multi-packs is helping spark category growth, particularly in MULO.

According to SPINS data, items 17 oz. and larger experienced the biggest increases in dollar share over the past year, gaining 39% in the natural channel and 113% in MULO. However, each still represents a relatively small piece of the total category within each channel — 8% in natural and 3% in MULO.

Meanwhile, items 14 oz. and smaller grew dollar share by 24% in the natural channel and 6% in MULO during the period. Items sized 14-17 oz. grew dollar share 23% in MULO, while falling 1% in the natural channel.

Leahy said that larger packaging options are influencing pricing, which was up across all retail channels.

“The price increase is I think higher than it would be normally just because of the larger sizes coming in,” she said. “It’s a small piece of the pie, but that will drive a higher price point,”

The data is for a 52-week period ending on 2/24/2019, and include kombucha beer.

Still Plenty of Room for Growth

In terms of assessing kombucha’s geographic distribution, SPINS didn’t as much reveal new insights as reinforce existing ones.

In a dollars-per-capita index vs. total U.S. average, California (155) and the West region (155), which includes Washington and Oregon, led the way. The Southeast was behind with 105, followed by the Northeast with 95 and the Plains by 94. According to Leahy, lower indexing in the Great Lakes (70), South Central (44) and Mid-South (87) indicates that the category still has plenty of runway to develop in those regions.

“In some ways, you look at this and say there is not a lot of ‘new’ news,” she said. “What I did take away from this was there is still a lot of opportunity and room to grow in places like the South, the Great Lakes and the mid-south.”